¿Qué es el NIE en España?

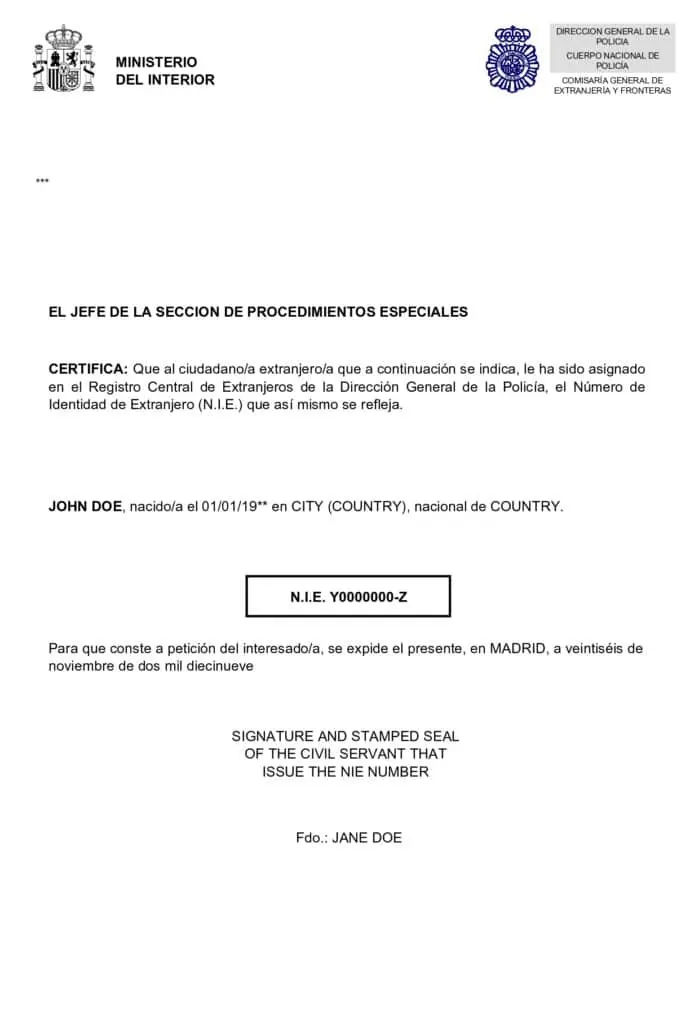

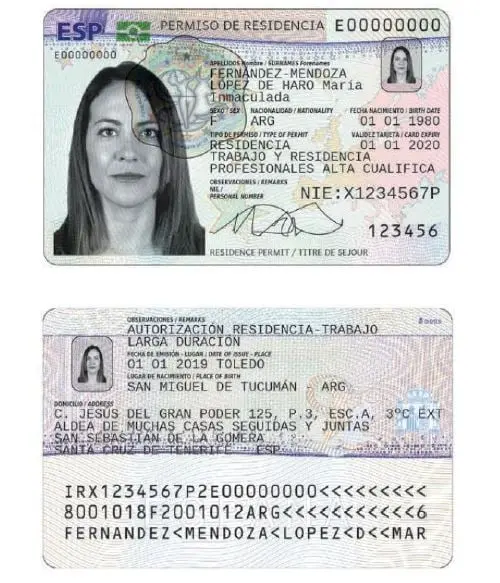

Este es su Número de Identificación de Extranjero. Es un número único asignado a todos los extranjeros que tienen relaciones con el gobierno español o instituciones financieras. Piense en él como su número de identificación fiscal español.

Entendiendo el NIE

El NIE es más que un simple número. Es una puerta de entrada para participar en el sistema español, pero viene con complejidades ocultas:

-

NIE de No Residente (Solución Temporal): Aunque puede obtener un NIE de no residente para transacciones específicas (por ejemplo, comprar propiedad), generalmente no es una solución a largo plazo. Si planea vivir en España, debe obtener un NIE de residente vinculado a un permiso de residencia válido.

!: Si inicialmente obtiene un NIE de no residente y luego se convierte en residente, el número generalmente permanecerá igual. Sin embargo, deberá actualizar su información con las autoridades fiscales.

-

El Requisito de "Justificación": Al solicitar un NIE, debe proporcionar una razón válida ("justificación"). Esto puede ser complicado.

- Justificaciones aceptables: Un contrato de compra firmado para una propiedad, un contrato de trabajo, una oferta formal de empleo, prueba de matrícula en un programa universitario.

- Justificaciones inaceptables: "Estoy planeando buscar trabajo." "Quiero abrir una cuenta bancaria en caso de que decida mudarme aquí." Sea específico y proporcione evidencia concreta.

-

Certificado de NIE Perdido o Robado: Si pierde su certificado de NIE, puede solicitar un duplicado ("duplicado"). Sin embargo, el proceso puede llevar tiempo, por lo que es esencial mantener su certificado en un lugar seguro. Se recomienda encarecidamente conocer su número de NIE de memoria.

-

NIE y Implicaciones Fiscales: Obtener un NIE no lo convierte automáticamente en residente fiscal. La residencia fiscal se determina por la "regla de los 183 días" y sus intereses económicos. Si pasa más de 183 días en España en un año calendario, generalmente se le considera residente fiscal y está sujeto al impuesto sobre la renta español.