Register your address (empadronamiento) as soon as you have a stable address

Many procedures (and everyday admin) become easier once you’re registered on the padrón at your local town hall.

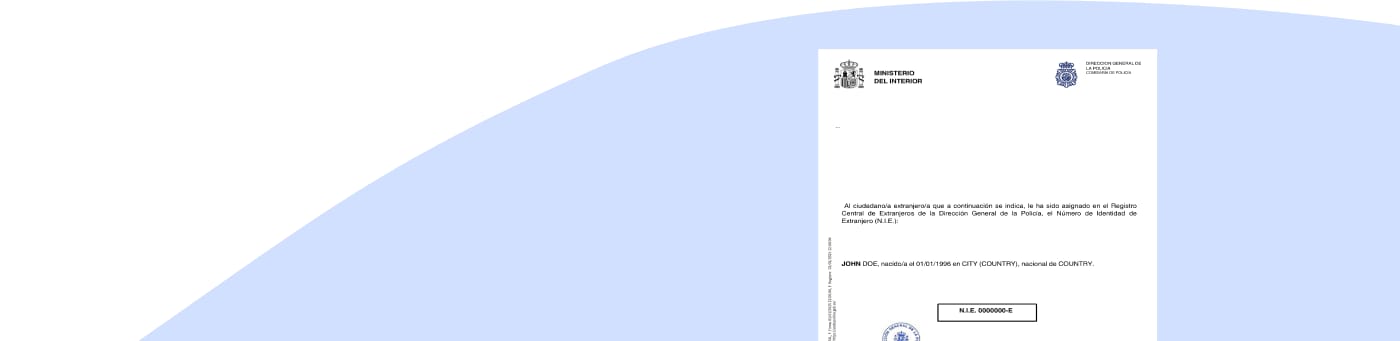

Requirements vary by city, but municipalities routinely accept for the application form an ID such as passport/NIE/TIE and proof connected to the address.

In the first weeks (setup that unlocks everything)

Get your Social Security number (NUSS/NAF) if you’ll work or need public-system registrations

Spain’s Social Security explains you can request a Número de la Seguridad Social (NUSS) and that it identifies you within the system.

Set up digital access: Cl@ve and/or FNMT digital certificate

These are extremely useful for appointments, filings, and online procedures.

- The Spanish government’s Cl@ve guidance notes foreigners can register using NIE with residence documentation.

- FNMT states that Spanish and foreign citizens with DNI or NIE can obtain a digital certificate.

After you have TIE/NIE and padrón (life admin)

Healthcare registration (rules vary by autonomous community)

If you’re employed and contributing, registration typically flows through Social Security and your regional health service. Many regions ask for a mix of ID (NIE/TIE) and empadronamiento to issue a health card; for example, Madrid’s public guidance references empadronamiento requirements for the tarjeta sanitaria.

If you have an S1 route (certain cases), Social Security has an online procedure to register it in Spain. (prestaciones.seg-social.es)

Banking, utilities, and contracts

Once you have your NIE/TIE in progress (and ideally padrón), it’s usually smoother to:

- open a bank account (if you haven't done ir prior to your visa application),

- set up a phone plan,

- put utilities in your name,

- and sign longer-term rentals.

If you’re a student

Student residents also follow a TIE path; the Policía’s extranjería portal includes the student TIE procedure and documents like the 790/012 fee reference.

Renewing your Spanish TIE/Visa in Spain

Step 1: Renewal (La Renovación)

Your first residence card is typically valid for one year. You cannot take its renewal for granted. You must proactively prove that you continue to meet the core conditions of the visa that brought you to Spain.

The renewal window is from 60 days before your card expires to 90 days after.

Renewing the Non-Lucrative Visa (NLV):

- Physical Presence Test: This is paramount. You must prove you resided in Spain for a minimum of 183 days during the first year. The government will check passport stamps and other data. Significant absences are grounds for denial.

- Financial Requirement: The first renewal grants a two-year residence card. Therefore, you must prove you have sufficient funds for the next two years. You must once again demonstrate funds equivalent to 800% of the annual IPREM for the main applicant and 200% for each dependent (e.g., ~€57,600 for a single applicant). This catches many people by surprise.

- "No Work" Rule Compliance: You must still demonstrate that you have not been working in Spain.

Renewing the Digital Nomad Visa (DNV):

- Continued Professional Activity: You must provide evidence that your remote work relationship continues. This means submitting recent invoices, updated contracts, proof of ongoing salary payments, or a new letter from your foreign employer.

- Proof of Tax Compliance: You will need to show that you are in good standing with the Spanish Tax Agency (Agencia Tributaria), having filed your taxes correctly under your chosen regime (special or standard).

Renewing Work Visas (Cuenta Ajena & Cuenta Propia):

- Employee (Cuenta Ajena): The renewal is simpler if you are still employed. You will need to provide your 'vida laboral' (official work history report from Social Security) to prove continuous employment and contributions.

- Self-Employed (Cuenta Propia): You must demonstrate your business is still active and solvent. This is typically done by providing your quarterly tax filings (IVA and IRPF forms) and Social Security payment receipts.

Step 2: Long-term residency in Spain (Residencia de Larga Duración)

This is the first major upgrade in your residency status in Spain and the primary goal for most expats after their initial renewals.

- Five-Year Rule: After residing legally and continuously in Spain for five years, you are eligible to apply for long-term residency.

- Defining "Continuously": The rules are specific. To be considered continuous, you cannot have been outside of Spain for more than 10 months in total during the five-year period, and generally, no single absence should exceed 6 consecutive months. Immigration authorities will scrutinize your passport for entry and exit stamps.

- Advantages: Achieving long-term residency decouples you from the conditions of your original visa. This is a monumental change.

- An NLV holder on a long-term residence permit can now work freely in Spain, either for a company or as a self-employed professional, without needing a separate work permit.

- The demanding financial proofs of the NLV or DNV are no longer required for renewal. The renewal process becomes a much simpler administrative formality.

- The card is valid for five years and is straightforward to renew. While the card has an expiry date, your status as a long-term resident is permanent.

Step 3: Spanish citizenship (Nacionalidad Española)

For those who see Spain as their permanent home, citizenship is the final step. It grants you a Spanish passport, the right to vote, and unrestricted EU freedom of movement.

Standard Path: 10 Years of Residency. The default requirement for applying for citizenship through naturalization is ten years of legal and continuous residency.

"Fast Tracks": Critical Exceptions to the 10-Year Rule.

- 2 Years of Residency: This is a massive advantage for nationals of Ibero-American countries (e.g., Brazil, Argentina, Mexico, Colombia), Andorra, the Philippines, Equatorial Guinea, and Portugal. Citizens of Sephardic origin also qualify for this accelerated path.

- 1 Year of Residency: For individuals who meet specific criteria, including being married to a Spanish citizen for one year while residing in Spain, or being born on Spanish territory.

Two Mandatory Exams: You must pass two tests to prove your integration:

1. DELE A2: A language exam proving a basic A2 level of Spanish proficiency. This tests your ability to handle simple, everyday conversations.

2. CCSE: A cultural exam (Conocimientos Constitucionales y Socioculturales de España) testing your knowledge of Spanish government, law, culture, and society.

- The Dual Citizenship Question (Crucial Information):

- The General Rule: Spain does not generally permit dual citizenship. To become Spanish, you are typically required to formally renounce your previous citizenship before a Spanish official.

- Major Exception: Citizens of the "fast track" Ibero-American countries, Andorra, the Philippines, Equatorial Guinea, and Portugal are exempt from this requirement. They can hold both their original and their new Spanish citizenship simultaneously. This is a significant strategic factor for eligible individuals.