How to Issue Social Security Payments as a Recibos Verdes Worker in Portugal

•

min read

Take off for Portugal now!

Dreaming of life in Portugal? Start your journey now and access to our app!

As a recibos verdes worker (self-employed or freelancer) in Portugal, one of your key responsibilities is paying social security contributions. These payments fund essential benefits, such as healthcare, pensions, and unemployment support, which are crucial for long-term financial security. The Portuguese Social Security system calculates your monthly contributions after you submit quarterly earnings declarations.

This guide will take you through the entire process—explaining the calculations, exemptions, and payment methods you need to understand in order to stay compliant.

Your social security contributions are calculated based on your quarterly earnings. The contribution rate is 21.4% for service providers, applied to 70% of your total income (referred to as your rendimento relevante or "relevant income"). If you are involved in the production or sale of goods or operate in the hospitality sector, the rate applies to 20% of your income.

For example:

- If you earn €6,000 in a quarter from providing services, the relevant income is €6,000 × 70% = €4,200.

- The contribution rate is 21.4%, so your contribution will be €4,200 × 21.4% = €898.80 for that quarter.

- This amount is divided into three equal monthly payments: €898.80 ÷ 3 = €299.60 per month.

Why does the contribution apply to either 70% or 20% of your income?

To account for business expenses, the government considers 70% of income for services and 20% for goods or hospitality when calculating social security contributions.

The government treats only a portion of freelancers' or self-employed workers' income as "profit," assuming they incur some costs while conducting their work.

How to submit the quarterly declaration

Every quarter, you must submit a declaration of your earnings to the Segurança Social (Social Security). You complete this online through the Segurança Social Direta (SSD) platform. The submission deadlines are:

- January: for earnings from October, November, and December of the previous year.

- April: for earnings from January, February, and March.

- July: for earnings from April, May, and June.

- October: for earnings from July, August, and September.

Step-by-Step: Submitting Your Declaration

1. Log into Segurança Social Direta: Use your NISS (Social Security Identification Number) and its password.

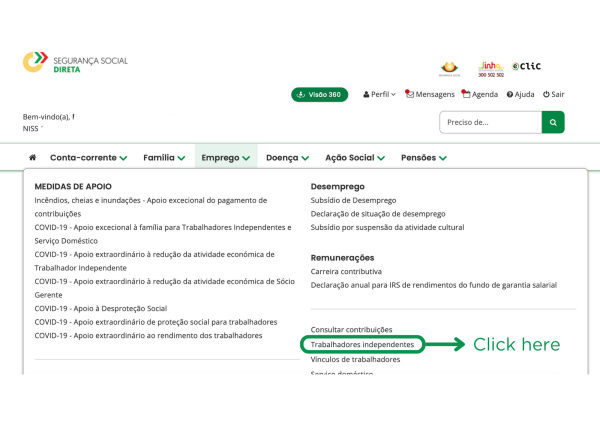

2. Go to "Emprego": Employment-related services are the focus of this section.

3. Select "Trabalhadores Independentes": This option is for self-employed workers.

4. Click "Regime Declaração Trimestral" This section will allow you to either view previous declarations or submit new ones.

Select the "Sim” (Yes) option if you had earning from your services during the quarterly.

Select the broad category that fits your work.

5. Enter your earnings for the quarter: The platform will ask you to declare the income you earned over the past three months.

The platform will present three fields for each month—fill them in accordingly.

Choose if you wish to insert any extra bonus or subsidies to be calculated.

6. Review the Calculation: After submitting your earnings, the system will automatically calculate your social security contribution for the following three months. This amount can be increased or decreased by 25% if you expect income changes.

7. Submit the Declaration: Once you're satisfied with the figures, confirm the submission.

If you don't have any earnings to declare, you still must pay the minimum value: €20.

This is how you must do it: Follow the previous steps until the 4th.

On the 4th step, do as it follows:

Select the "Não” (No) option if you didn't have any earnings from your services during the quarterly.

Confirm the €20 minimum payment, and submit.

You'll see the same page as the step 7, as you submit the declaration.

Why submit quarterly?

The quarterly declaration allows the social security system to track your income more accurately, ensuring that you contribute based on real earnings.

This system offers flexibility, as contributions fluctuate with your income. It also prevents situations where a static contribution amount might overburden you during low-income periods.

⚠️ If you hire an accountant on a monthly basis, and not only during IRS period, this should be among their responsabilities, and they will submit it for you.

What if I don't have an account at Segurança Social Direta?

Don't worry, we got you covered! Below, you can find a step-by-step explanation of how to request access to the Segurança Social Direta platform.

What is Segurança Social Direta?

The Portuguese government provides Segurança Social Direta (SSD), an online platform where individuals can manage their Social Security affairs. Whether you are a freelancer, self-employed, or an employer, the SSD portal provides the following features:

- Submit quarterly earnings declarations.

- Check the status of your Social Security contributions.

- Generate payment references.

- Request documentation related to your Social Security account.

- Manage requests for exemptions or adjustments in contributions.

For freelancers and recibos verdes workers, this platform is crucial because it’s where you will declare your quarterly income, calculate your contributions, and make payments.

Registering and accessing Segurança Social Direta

Before you can manage your contributions or submit quarterly declarations, you must register on Segurança Social Direta. Here’s a step-by-step guide on how to do it:

Step 1: Request access credentials

To access SSD, you will need a NISS (Número de Identificação da Segurança Social) and a password. If you're a new freelancer, especially as a foreign, you'll need to apply for it at a Social Security office or directly with us, here at AnchorLess.

Once you have your NISS:

- Go to the Segurança Social Direta website: Segurança Social Direta.

- Click on "Registar-se" (Register) at the top right corner of the page.

- You will be asked to provide your NISS and personal details such as your full name, date of birth, and taxpayer number (NIF).

- After filling out the registration form, you will receive an email or physical mail with your access credentials, including a password.

Step 2: Log into Segurança Social Direta

Once you have your password, you can log into the SSD platform.

- Return to the Segurança Social Direta homepage.

- Click on “Iniciar Sessão” (Login).

- Enter your NISS and password.

You now have complete access to your Social Security account.

Monthly payment of social security contributions

Once you've submitted your quarterly declaration, your monthly payments are calculated and distributed across the next three months. Each month, you must make payments between the 10th and the 20th for the previous month.

Methods of payment

You can choose from several methods to pay your contributions:

- Multibanco: You can use the reference number from the SSD platform to make payments at any ATM, as long as you have a Portuguese bank account.

- Home Banking: Make the payment online through your bank's website.

- Direct Debit: Set up automatic withdrawals from your bank account through the SSD platform.

- Social Security Offices: Pay in person at designated institutions or Social Security offices.

Late Payment Penalties

If you fail to make your payments on time, you will face penalties. If you're up to 30 days late, the fine is relatively small. However, if you delay payments beyond 30 days, you may face larger penalties and legal consequences.

How to pay your Recibos Verdes's Social Security tax?

1. Log into Segurança Social Direta: Use your NISS (Social Security Identification Number) and its password.

2. Go to "Conta Corrente": Payment-related services are the focus of this section.

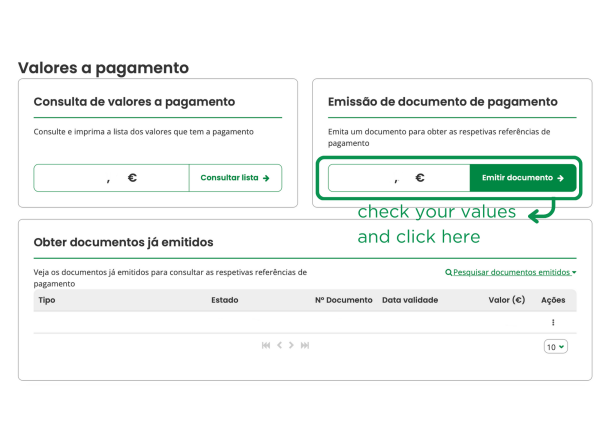

3. Select "Consultar valores a pagar": This is where you see what is due and create the payment orders.

4. Check what is due and click "Emitir documento": This section will allow you to select which social security taxes will be paid.

5. Select "Contribuições - Trabalhador Independente”: This section will allow you to select what values will be paid.

6. Select the monthly(s) payment(s) you wish to pay: You can choose as many as you want, juts keep in mind late ones will have interest added.

7. Receive your payment information: You'll have the Multibanco option (ATM with Portuguese bank account), online banking through multibanco option, and in-person, directly at Social Security.

Exemptions and special cases

There are several situations where recibos verdes workers may be exempt from social security contributions. If you meet certain criteria, you might not need to contribute for a limited period.

12-Month Exemption for New Freelancers

If you're just starting out as a self-employed worker and have just opened a Recibos Verdes activity, you receive a 12-month exemption from social security contributions.

This is especially helpful when you're still building up your client base and earning potential. However, note that after this initial period, you must begin paying contributions based on your income.

Simultaneous Employment Exemption

If you work both as a freelancer and as an employee for a company, you may be exempt from social security contributions as long as

- Your earnings from self-employment do not exceed four times the IAS (Indexante dos Apoios Sociais, Social Support Index rate), which is €1,921.72 in 2024.

- You work for different entities, and your salaried job provides sufficient social security coverage.

In cases where your freelance income exceeds the four IAS limits, you only pay contributions for the amount above that threshold.

Pensioners and disabled workers

Workers receiving a pension for old age, disability, or serious injury are exempt from social security contributions. The exemption also applies if you are receiving parental leave benefits or are on sick leave.

What if I don't earn any income?

If you earn no income in a given quarter, you are still required to submit a declaration. However, your contribution will be the minimum amount of €20 per month. This ensures that you remain within the system, even if your income fluctuates.

Adjusting your contributions: flexibility for freelancers

As a self-employed worker, you have the flexibility to adjust your contributions up or down by up to 25%. This option is helpful if you expect a particularly strong or weak quarter, allowing you to better manage cash flow.

For example:

- If your contribution based on a quarterly declaration is €300 per month, you can adjust this by up to 25%.

- You have the option to either increase your contribution to €375 or decrease it to €225 per month.

This flexibility allows for better control over your contributions and can help prevent overburdening during slow business periods.

Final words

Paying social security as a recibos verdes worker is crucial to ensuring access to public benefits, including healthcare, pensions, and unemployment support. By following the process outlined above—submitting quarterly declarations, adjusting contributions if necessary, and making timely monthly payments—you’ll stay compliant with Portuguese regulations and protect your long-term financial wellbeing.

Managing your social security obligations may seem complicated at first, but the system offers flexibility and clear guidelines to help self-employed workers like you maintain steady contributions throughout the year. In Portugal, professional independence depends on understanding and managing these contributions, whether you're a beginner or an experienced freelancer.

Start your new life in Portugal

Turn relocation stress into success with AnchorLess.

Relocating to Portugal made simple.

AnchorLess is not a bank, accounting, tax, investment, or legal advisor. We serve as an intermediary, streamlining your access to accredited financial and legal professionals for your relocation in Europe.

🇵🇹 MOVE TO PORTUGAL

Services

Guides

🇪🇸 MOVE TO SPAIN

Services

Guides

Resources

© 2022 - 2026 anchorless.io, all rights reserved.