Step-by-step: opening a Portuguese bank account (resident or non-resident)

What are the steps to open a bank account in Portugal as a foreigner?

1. Clarify your profile (resident vs non-resident)

This changes the bank’s onboarding and which proof of address is accepted.

2. Choose the account type you actually need

For example: a simple current account for day-to-day use, or an account you’ll use mainly for visa preparation and initial settlement.

3. Decide your opening route: online vs branch

Online can be faster when available, but many applicants still succeed fastest with a branch appointment, especially with a non-resident profile and the availability to go to Portugal.

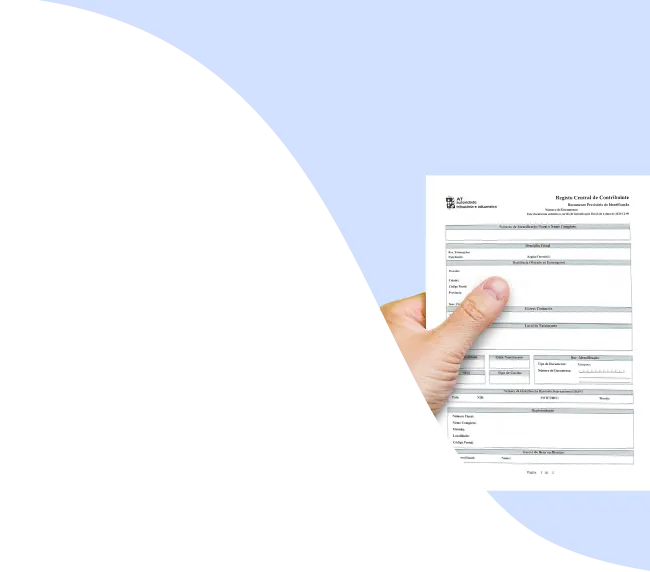

4. Collect your documents (use the checklist above)

Keep digital copies ready even if you’re going in person, branches often scan documents.

5. Complete identity verification

This may be done at a branch, by video identification, or via the bank’s app, depending on the institution.

6. Make the initial deposit (if required)

Most accounts require a minimum opening deposit; a few do not.

7. Activate digital banking and payment tools

As soon as your account is live, set up the app, security factors, and your payment cards so you can use the account immediately.

Why open a bank account in Portugal?

1) Easier day-to-day setup with a Portuguese IBAN

In Portugal, many recurring services work smoothly with direct debit from a Portuguese IBAN, especially utilities and telecoms. Even when alternatives exist, a local account typically reduces friction when you are setting up contracts, switching providers, or handling deposits.

2) Access to popular local Portuguese payment tools

A Portuguese account makes it easier to use local payment and transfer options that are widely adopted in Portugal. Availability and fees can depend on the bank and the account plan, but the convenience factor is real once you’re living here.

3) Practical for holding funds locally in Portugal

If you are moving money for rent, deposits, relocation costs, or ongoing living expenses, having a Portuguese account can simplify transfers and reduce back-and-forth with landlords, service providers, and institutions that prefer local banking details.

4) Helpful for expats preparing paperwork

For many expats, the biggest advantage is timing: Besides being essential for your visa process, a local account can help you move faster on administrative steps and feel more “ready” when appointments and document requests arrive. Even when not strictly mandatory, it is commonly requested and often expected during a relocation journey.