Why is AnchorLess your trusted partner for your Portuguese NIF? 👋

When you request your NIF online here at AnchorLess, we automatically ask for your password, without extra fees.

We'll send it to you automatically, once again protecting your data.

For this reason, we advise EU nationals to opt for a fiscal representative when purchasing their NIF from us, even though it's not technically required. This way, your password will arrive safely in your inbox instead of being at risk of loss in the mail system.

The NIF application process is simple with a short duration and your Portuguese NIF number will be issued in just a few days.

How long does it take for my 'Finanças' Password to arrive?

Due to delays in the mail network, it may take 2 (or a bit more) weeks for your password letter to arrive.

If you are an EU citizen and your NIF address is outside Portugal, it will take longer.

What should I do in 'Finanças'?

You can manage your personal details, your income and invoices to ensure that you'll have a larger tax deduction or return. 💰

The Portuguese tax system offers a category-based invoice classification, where you can separate receipts according to their service and increase your final deduction or return.

You can use the 'Finanças' portal or the 'E-fatura' app to do it.

What should I do after receiving my NIF and 'Finanças' password?

Basically become a Portuguese tax resident: change your NIF password and fiscal address.

However, be aware that switching your NIF address to a Portuguese address will inform authorities that you are a tax resident in Portugal, thereby requiring you to pay taxes there as well.

To do the first is simple, but for the latter, you must be living in Portugal with a lease, a residence permit, or 'Manifestação de Interesse' in place.

What data will the Portuguese government keep about me?

The Portuguese Tax Authority uses the NIF (Tax Identification Number) as an essential tool to calculate and manage your fiscal obligations and economic activities in Portugal. Numerous activities necessitate it, especially those related to income receipt, tax payment, and even daily purchases.

Those are the data that the Portuguese government will keep: any financial activity, purchase, or contract you may include or register your NIF, all the economic activities.

For instance, if you request your supermarket invoice along with your NIF, they will have this information available.

How can I use my Portuguese NIF?

You’ll need a NIF (Tax Identification Number) for a wide range of essential and non-essential transactions and activities in Portugal, including:

- Buying, selling or renting property

- Inheriting Portuguese assets through a last will and testament

- Opening a bank account

- Applying for credit, such as a mortgage or signing a mobile phone contract

- Receiving income for work or business activities

- Enrolling at a Portuguese university

- Setting up utilities or telecommunications

- Buying a car or applying for a Portuguese driving license

- Getting insurance

- Registering for a gym

You can also include your NIF in the following purchases:

- Restaurants;

- Supermarkets;

- Drugstores;

- Bookstores;

- Retail;

- Public transport;

- Healthcare appointments;

- General repair (vehicles or home)

Each one has a different bracket that could result in discounts and benefits when filling out your IRS in Portugal.

What happens if I don't have a Portuguese NIF?

Living in Portugal without a NIF doesn't incur criminal penalties. Without a NIF, you won't be able to accomplish any of the aforementioned tasks, which will significantly hinder your daily business operations.

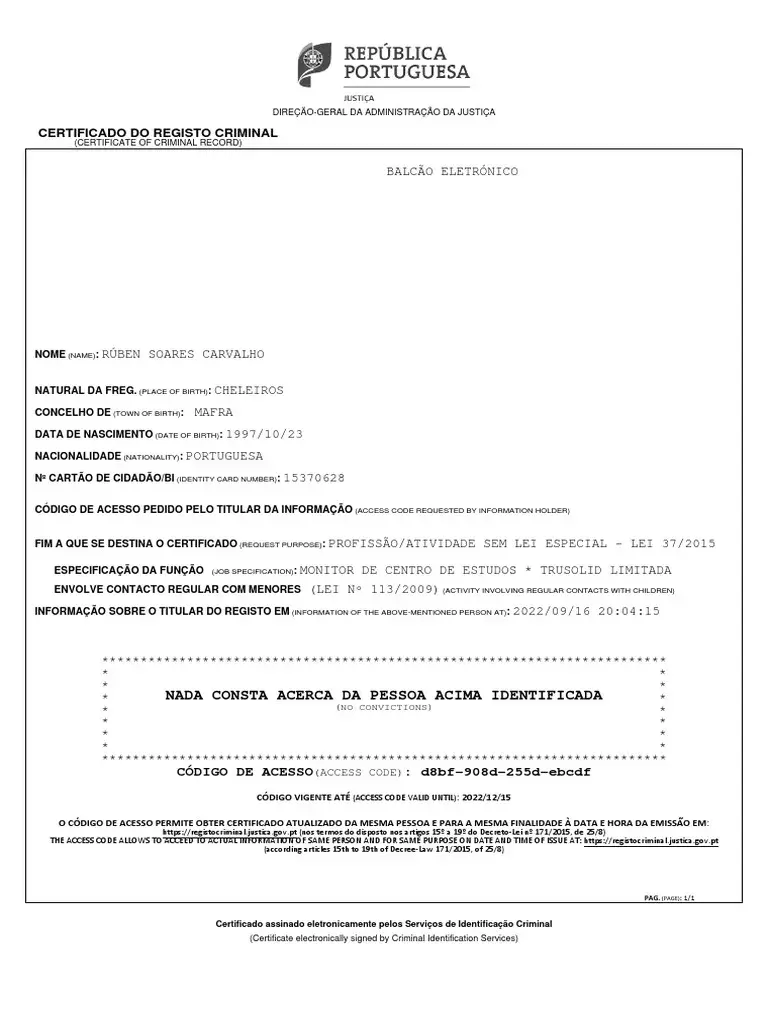

How can I check if my Portuguese NIF is valid?

While nif.pt is not an official governmental tool, you can try to use it to verify the validity of a NIF.

The only way to use an official government tool is to log into Portal das Finanças and insert your NIF with its password. If you successfully log in, it indicates that your NIF is valid.

Can I cancel my NIF before leaving Portugal permanently?

Unfortunately, no!

The NIF is irrevocable once issued. However, if you stop declaring your income through the Portuguese tax system, have no properties or financial obligations (such as a phone bill), and do not acquire (or fully pay) any tax debt, as per AT's current status, you won't have any financial obligations to declare or pay with the tax authority.

What if I lose my NIF Portugal, how can I find it?

This can be a bit more complicated.

As of now, the only solution we can offer is to direct your situation to one of our lawyers with the original document you used to request your lost NIF Portugal.

They will work directly with Finanças to retrieve your lost Portuguese NIF number.

Are there any changes to the Portuguese NIF number in 2026?

There were none!

Though Portugal implemented several new immigration and nationality rules, the NIF remained pretty much unaffected.