Recibos Verdes Invoice: Step-by-Step Guide

•

min read

Take off for Portugal now!

Dreaming of life in Portugal? Start your journey now and access to our app!

Issuing receipts as a freelancer (trabalhador independente) in Portugal using the recibo verde system is crucial for complying with tax regulations.

Whether you're a regular freelancer or are issuing receipts for an isolated act (ato isolado), you must complete this process through the Portal das Finanças.

Below is a deep guide explaining the steps, nuances, and additional information like client registration, VAT, IRS withholding, and more.

What Are Fatura, Recibo, and Fatura-Recibo?

Before issuing receipts, it’s essential to understand the basic terminology:

- Fatura (Invoice): We issue this document when we provide a service or product, but we have not yet received payment. It serves as a formal request for payment.

- Recibo (Receipt): After receiving payment for a service or product, we issue a recibo to confirm the transaction.

- Fatura-Recibo (Invoice-Receipt): Providers use this combination of two documents when they provide a service or product and simultaneously receive payment. Most freelancers opt for this document for its simplicity and efficiency.

What is Ato Isolado?

Individuals who do not regularly perform freelance work issue an ato isolado, which is a one-time transaction.

This type of transaction allows someone to issue an invoice for a specific service or sale without the need for continuous registration as a freelancer. However, the nature of the service or product may require the application of VAT.

Portuguese tax laws allow only one ato isolado per year, so it's important to use this option only for rare transactions.

Accessing the Portal das Finanças

To issue any receipts or invoices, you need to log into the Portal das Finanças, which is the Portuguese government's official tax platform. Here are the options available for logging in:

- Citizen's Card (Cartão de Cidadão): requires a card reader.

- Chave Móvel Digital: A mobile digital key linked to your personal identification.

- NIF (Número de Identificação Fiscal) and password: If you haven’t set up an account, you can request your credentials online.

Once logged in, navigate to the “Faturas e Recibos” section using one of the following methods:

- Use the search bar to type "Faturas e Recibos" and select the appropriate link.

- Navigate manually through the Serviços Tributários > Serviços > Faturas e Recibos menu.

Step-by-Step Guide to Issuing Receipts or Invoices

1. Select the document to issue

From the “Faturas e Recibos” menu, select the "Emitir" option, which gives you the following choices:

- Fatura: Use this if you haven’t received payment yet.

- Fatura-Recibo: Use this for issuing a combined invoice and receipt when you receive payment at the same time.

- Recibo: To be used when the payment has been received after a fatura has been issued.

- Ato Isolado: For issuing a receipt for a single, non-recurring transaction.

2. Fill in transaction details

When issuing a fatura or fatura-recibo, you must complete a form that includes the following information:

- Transaction Date: Indicate the date of service or product delivery or the receipt of payment.

- Type: Choose between invoice, receipt, or invoice-receipt depending on the transaction.

- Activity Code (CIRS/CAE): Select the appropriate professional activity code for your service or product. This is based on your registration with the tax authorities.

- Client Information: If your client is a consumer (individual), leave this section blank. For businesses, enter the NIF (tax number), name, and address.

3. Describe the Service or Product

Provide a detailed description of the service or product in the Produtos, Serviços ou Outros section. You’ll also need to indicate:

- Unit Price (Valor unitário): Price per service or product unit.

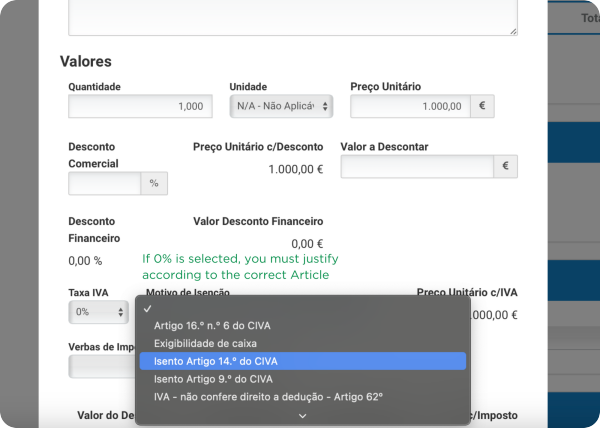

- IVA (VAT) Rate: Select the appropriate VAT rate. Freelancers whose annual income is less than €14,500 are generally exempt from VAT under Article 53 of the VAT Code. However, you must still declare this exemption.

4. IRS withholding (Retenção na Fonte)

For certain services provided to companies or professionals, IRS withholding (typically 25%) is required.

If the client operates under the IRS withholding regime, check the appropriate box. Freelancers earning less than €14,500 annually are typically exempt.

5. Payment information

You can optionally fill out the payment information to track your payment method (e.g., bank transfer, cash, etc.).

6. Finalize the document

After filling in all the fields, click Emitir. Confirm the submission, and the document will be generated.

Your client will also have access to it in their account if they use the Portal das Finanças.

Issuing receipts for previously issued invoices

If you issue an invoice but haven’t received payment yet, you must issue a receipt once the payment is made.

- Go to the Recibo section.

- Search for the relevant invoice using the client's name or the invoice number.

- Click on Emitir Recibo, check the payment details, and then confirm.

- If necessary, apply IRS withholding for the service, following the instructions above.

Managing Client and Product Profiles

To streamline your work, you can create client and product/service profiles, saving you time for future transactions.

Creating Client Profiles

If you frequently work with the same clients, it’s useful to create a client profile. This allows you to automatically populate the client details during the receipt issuance process, saving time:

- Select “Clientes” from the Emitir menu.

- Click “Adicionar” to add a new client.

- Fill in the required fields, such as the client’s NIF, name, and address, and click Guardar.

⚠️ If your client is foreign, you can put their Tax ID in the NIF area.

Creating Product/Service Profiles

Similarly, you can create profiles for the services or products you offer:

- Select “Produtos, Serviços, ou Outros” from the Emitir menu.

- Click “Adicionar” to add a new product or service.

- Fill in the required details, including the product or service type and description, and save it for future use.

Managing Ato Isolado

As we said before, for one-time transactions, the fatura-recibo of an ato isolado is the go-to option.

What is Ato Isolado, and When Should You Use It?

An Ato Isolado is a one-time invoice used by individuals who are not registered as freelancers (don't have recibos verdes) or do not have a regular independent activity but perform a single transaction. It’s typically used for:

- One-off services or products are sold.

- You engage in an activity that isn't part of your regular professional work.

- Individuals who have not formally registered as freelancers (using recibo verde) are in need of assistance.

Key Points about Ato Isolado

- You can only issue one ato isolado per year (That's the main thing ypu must keep in mind!).

- You must still include the income from an ato isolado in your annual IRS declaration.

- Unless there is an exemption, the VAT (IVA) rate must apply.

Steps to Issue an Ato Isolado

- Log into the Portal das Finanças: Similar to issuing a recibo verde, you’ll need to log into the Portal das Finanças with your NIF and password.

- Access the Ato Isolado Section: Navigate to the Faturas e Recibos section and select Emitir Fatura de Ato Isolado.

- Fill out the required information: You’ll need to provide:

- Description of the Service/Product.

- Price and VAT: Include the appropriate VAT rate if applicable.

- Client Information: Fill out the details if necessary.

Confirm and Issue: Review the details, confirm, and issue the ato isolado. This will generate the relevant document, which you should send to the client.

-1730157484.webp)

Tax compliance and social security

When filing annual taxes (IRS Model 3), you must declare every receipt you issue as a freelancer.

Additionally, as a recibo verde freelancer, you are required to contribute to Segurança Social, unless you are exempt for the first year. Freelancers are required to contribute at a rate of 21.4%, with a quarterly process based on their declared income.

Final words

Issuing invoices and receipts as a recibo verde freelancer may seem complex at first, but the Portal das Finanças provides a user-friendly platform for managing your transactions.

By following this guide, you can ensure compliance with Portuguese tax laws while streamlining your freelance operations. For one-time jobs, the ato isolado option provides flexibility without requiring continuous freelance registration. Always keep your client and service profiles updated for faster transactions and avoid mistakes that could lead to fines or delays in payment.

Start your new life in Portugal

Turn relocation stress into success with AnchorLess.

Relocating to Portugal made simple.

AnchorLess is not a bank, accounting, tax, investment, or legal advisor. We serve as an intermediary, streamlining your access to accredited financial and legal professionals for your relocation in Europe.

🇵🇹 MOVE TO PORTUGAL

Services

Guides

🇪🇸 MOVE TO SPAIN

Services

Guides

Resources

© 2022 - 2026 anchorless.io, all rights reserved.