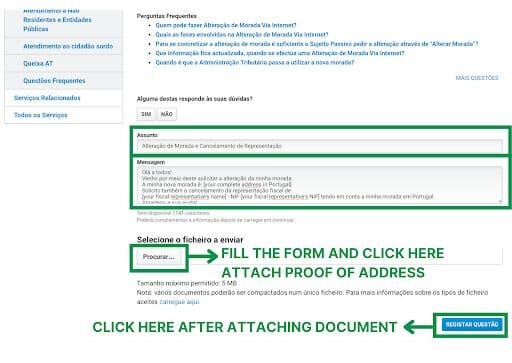

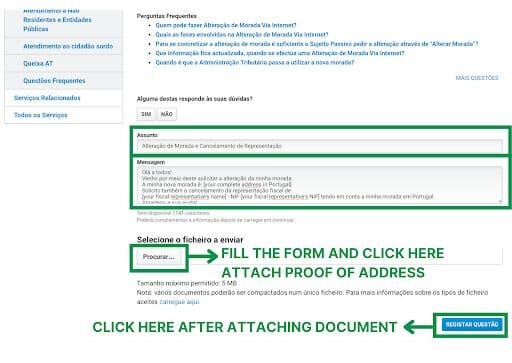

7 - After completing the message area, you'll need to attach the documents requested (ID, proof of accommodation and legal status) and click on 'Registar Questão' at the bottom right

A message must show informing:

"A Autoridade Tributária e Aduaneira (AT) agradece o seu contacto. O pedido fica registado para análise e tratamento.

Com os melhores cumprimentos"

AT- Autoridade Tributária e Aduaneira

This means you are all set!

How do I know if my NIF address was changed?

You must redo steps 1-3 or access this link. Keep in mind that this process may take up to a couple of weeks to complete. But you can check after one business day.

After redoing step 3, when the 'Pedidos de Informações/Esclarecimentos' area appears, below the 'Interações Registadas' area, you'll take a look at the options available on a blue and white table. Find the option with 'Morada' or 'Alteração. Click on 'Ver Pedido'.

There you may find two situations:

First instance

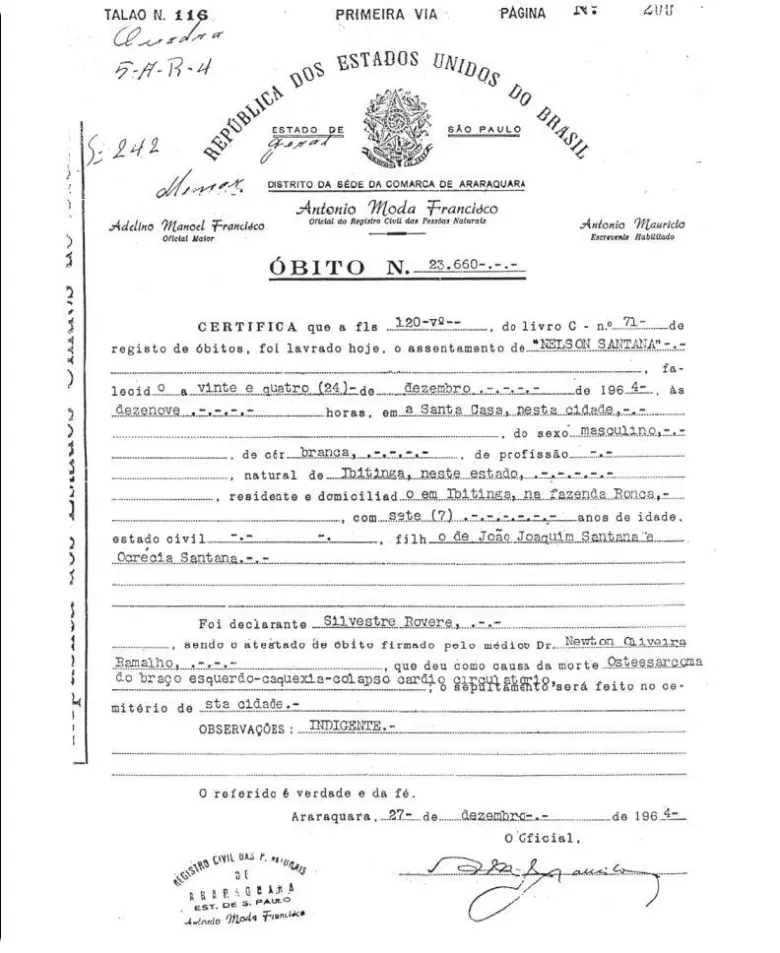

'Finanças' may randomly request your signature to finalise your change. You'll see a notification like the one below, in which you'll click 'Alteração para assinar', and you'll download this document to sign it.

Verify the accuracy of your information, sign the document on the highlighted area at the bottom of the second page, and enter the date in the format DD/MM/YY.

After that, scan the document and upload it with the message 'Veja documento anexado' in the same location where you downloaded it.

After that, you'll wait another 1-2 business days, and you'll proceed to the next step.

Second instance

Then comes the second situation: if your signature wasn't requested, or if it was, and you submitted the document, you will follow the previous steps to check the status of your request, and your updated NIF document will be ready for use and download.