What you need to know before you leave your country and move to Portugal

Portugal is a great place to live, with amazing weather, and though many speak English in the country, it still is a good idea to learn some basic Portuguese before leaving your home country.

Such a recommendation should not be taken lightly as the Portuguese population may not necessarily master English outside the non-touristic areas (think about small villages with no more than 500 habitants), especially if you plan to move outside the big cities, like Lisbon, the Algarve or Porto.

Also, although the average price of a property is lower, the popularity of Lisbon is increasing the pressure on land prices. If you want to live in Portugal, you have to plan for the rent as it represents the main expense, especially in Lisbon. Regarding other expenses, you should know that the standard of living is particularly 20% less expensive than in some other European countries, and when it comes to the US the difference is more notable.

Here are some basic tasks that need to be done by future expatriates wishing to live in Portugal:

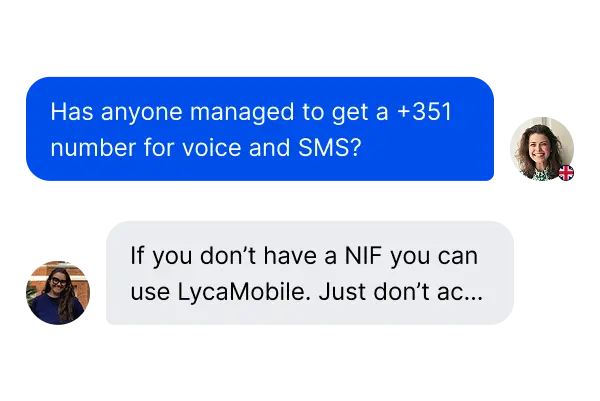

- Get a NIF, as it will be needed for every procedure in Portugal

- Get your CRUE if you are an EU/EEA/Swiss citizen

- If you are not an EU citizen, choose the ideal visa for your situation

- Check the local immigrant community, and research life in Portugal as an expat

- Open a Portuguese bank account in Portugal to better manage your finances

List of visas in Portugal

- D1 - Work Visa: Suitable for individuals who have a job offer from a Portuguese company.

- D2 - Entrepreneur Visa: Ideal for entrepreneurs with a business plan and funding who wish to expand their businesses in Portugal, also considering its option of the Start-Up Visa in Portugal.

- D3 - Highly Qualified Worker Visa: Designed for professionals in tech, science, or high-ranking positions who have a job offer in Portugal.

- D4 - Student Visa: For those who plan to study in Portugal and have been accepted into an accredited institution.

- D5 - Mobile Student Visa: Specifically for students or interns transferring from another EU institution to complete their studies or internships in Portugal.

- D6 - Family Reunification Visa: For family members joining a legal Portuguese resident or an EU citizen living in Portugal.

- D7 - Passive Income Visa: Ideal for individuals with passive income from retirement, investments, or property management. For those wishing to retire, we cover the essentials here.

- D8 - Digital Nomad Visa: A solution for remote workers intending to live in Portugal, and dive into its prolific communities in Lisbon, Porto and the Algarve.

- Golden Visa or ARI: A prestigious visa for high-value investments in art or the Portuguese stock market.

Exploring our site, you will find a list of country-by-country guides to relocating to Portugal: